Advanced Micro Devices‘ (NASDAQ: AMD) artificial intelligence (AI)-fueled rally has come to a screeching halt in 2024. Shares of the chipmaker are down 29% since the beginning of March, when they were trading at a 52-week high, and the company’s latest results aren’t going to help arrest the slide.

AMD released first-quarter 2024 results on April 30, and investors pressed the panic button. Let’s see why that was the case.

Results were not strong enough to justify AMD’s expensive valuation

AMD reported Q1 revenue of $5.47 billion, an increase of just 2% from the year-ago period. The company’s non-GAAP earnings also increased at a tepid pace of just 3% year over year to $0.62 per share during the quarter. Analysts were looking for $0.62 per share in earnings on $5.48 billion in revenue, which means AMD barely met the bottom-line estimate and failed to satisfy the revenue expectation.

The guidance didn’t inspire much confidence either. AMD expects second-quarter revenue to land at $5.7 billion, which would be a year-over-year increase of just 6%. Though the Q2 revenue forecast points toward a slight acceleration in AMD’s growth, Wall Street was expecting slightly higher revenue of $5.73 billion.

For a stock that’s trading at an expensive 218 times trailing earnings, AMD needed to deliver much stronger growth to justify its rich multiple. The company managed to do that in two of its business segments, which are already reaping the benefits of the proliferation of AI, but weakness in the other two business segments weighed on its financial performance.

More specifically, AMD’s gaming revenue was down 48% year over year to $922 million. This steep decline was a result of poor demand for AMD’s semi-custom chips, which are deployed in gaming consoles from Microsoft and Sony, as well as weak sales of the company’s gaming graphics cards. The weakness in this segment isn’t surprising, as sales of personal computers (PCs), where gaming graphics cards are deployed, were weak last year.

Additionally, the video gaming market was flat last year. However, market research firm Newzoo is forecasting an improvement in console sales this year. So AMD could witness a gradual improvement in its gaming revenue as the year progresses.

On the other hand, the company’s revenue from the embedded segment fell 46% year over year to $846 million. AMD’s embedded processors are deployed in multiple industries ranging from automotive to industrial to networking to storage, among others. AMD points out that customers are working through their existing inventory in this market, which explains why the demand for its embedded chips has remained weak of late.

However, AMD claims that its design win momentum in the embedded market remains robust, which means that its embedded processors have been selected for deployment into more products in the future. Once these products go into production, AMD should ideally witness an improvement in the demand for its embedded processors, especially considering that the company claims that its new offerings are capable of tackling AI workloads faster than the previous-generation processors.

This brings us to the two segments where AMD is clocking impressive growth now thanks to the growing adoption of AI, and which are likely to drive a solid acceleration in the company’s growth in the future.

These businesses are benefiting big time from AI adoption

AMD reported record revenue of $2.3 billion in the data center business last quarter, a stellar increase of 80% over the year-ago period. The company attributed this eye-popping growth to the booming demand for its AI GPUs (graphics processing units) as well as server processors.

The chip giant points out that shipments of its MI300X AI accelerators are ramping up strongly, a trend that’s likely to continue as there are “more than 100 enterprise and AI customers actively developing or deploying MI300X.” AMD has already sold $1 billion worth of these chips in the past two quarters, and now expects to finish the year with $4 billion in revenue from sales of data center GPUs.

That points toward an improvement in the company’s quarterly revenue run rate from the data center GPU market. It is also worth noting that AMD sold $400 million worth of its AI accelerators in the fourth quarter of 2023 when its new AI chips started going on sale. Also, the company’s $4 billion revenue forecast from this segment for 2024 is double its original expectation of $2 billion, and was higher than the $3.5 billion revenue forecast it issued in January this year.

So AMD’s potential revenue pipeline from sales of AI chips is increasing at a nice pace, suggesting that its data center business could continue growing going forward.

Meanwhile, AMD’s revenue in the client business was also up an impressive 85% over the year-ago quarter to $1.4 billion. The company is now witnessing a nice turnaround in the demand for its PC processors thanks to this market’s recovery, as well as the growing demand for AI-enabled PCs. The company is offering dedicated AI accelerators on its CPUs, which places it in a nice position to capitalize on the incoming AI PC boom. In the words of CEO Lisa Su:

We see AI as the biggest inflection point in PCs since the internet with the ability to deliver unprecedented productivity and usability gains. We’re working very closely with Microsoft and a broad ecosystem of partners to enable the next generation of AI experiences powered by Ryzen processors with more than 150 ISVs on track to be developing for AMD AI PCs by the end of the year.

With market research firm Canalys expecting AI PC shipments to increase at an annual rate of 44% through 2028, investors can expect AMD’s client business to deliver robust growth in the coming years.

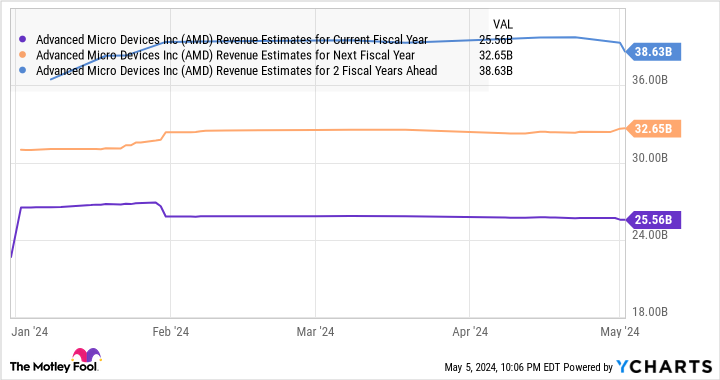

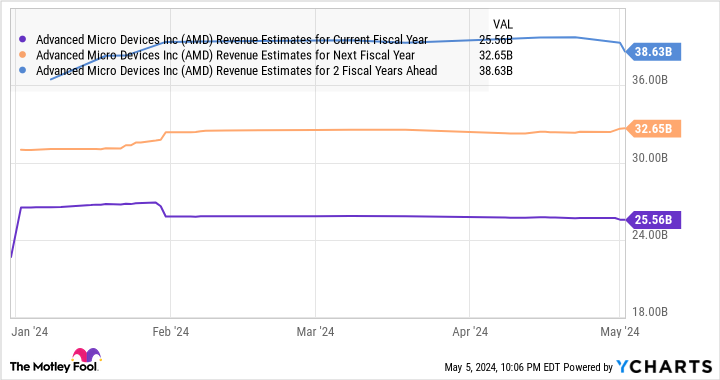

In all, the data center and the client business produced 67% of the company’s top line last quarter. They are in great health right now and are capable of moving the needle in a bigger way for AMD thanks to AI-related catalysts. Throw in a potential turnaround in the other two segments, and it is easy to see why AMD’s top-line growth is expected to gain momentum in 2025 and 2026 following an estimated increase of 13% this year from last year’s level of $22.7 billion.

Even better, analysts are forecasting AMD’s earnings to increase at an annual rate of 25% for the next five years. That may indeed happen thanks to the catalysts discussed above, which means that AMD’s earnings could hit $8.09 per share at the end of 2028 (using its 2023 earnings of $2.65 per share as the base).

AMD has a five-year average forward earnings multiple of 33. Multiplying that with the projected earnings in 2028 points toward a stock price of $267, a potential increase of 78% from current levels. That’s why investors would do well to use AMD’s pullback as a buying opportunity, as this AI stock could turn out to be a winner in the long run once it starts growing at a faster pace.

Should you invest $1,000 in Advanced Micro Devices right now?

Before you buy stock in Advanced Micro Devices, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Advanced Micro Devices wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $564,547!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of May 6, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

1 Artificial Intelligence (AI) Stock Down 29% to Buy Right Now Before It Soars 78% was originally published by The Motley Fool