People invest in dividend stocks for various reasons. Some want the passive income; others reinvest the cash to boost long-term returns; still others find that corporations that can dish out regular (and growing) payouts are worth investing in. But few such investors would include dividend cuts on their wish list — most want the payouts to go for as long as possible.

Though many income stocks will eventually have to suspend or decrease their dividends, some seem solid enough to pay investors for a lifetime. Let’s consider two examples: AbbVie (NYSE: ABBV) and Visa (NYSE: V).

1. AbbVie

AbbVie was originally a subdivision of Abbott Laboratories. The drugmaker split from its former parent company in 2013. Since then, AbbVie has been known for at least two things: its blockbuster rheumatoid arthritis drug Humira, and its consistent dividend increases.

However, things are changing. Humira has been off-patent in the U.S. since last year. Considering that the drug was AbbVie’s biggest growth driver for the past decade, it’s normal for shareholders to worry a bit about what will happen to its payouts.

But AbbVie is showing that it’s a strong company with or without Humira. Though revenue and earnings fell after the immunology medicine lost exclusivity, AbbVie can count on two other drugs in this area to fill the gap eventually: Skyrizi and Rinvoq actually compete with Humira in several indications. Combined revenue from these two medicines should hit $27 billion by 2027, according to management. That’s well above Humira’s peak annual sales.

AbbVie is an innovative company that should regularly continue delivering brand-new medicines. The drugmaker planned ahead for Humira’s loss of patent exclusivity; it will almost certainly do the same for Skyrizi and Rinvoq, and whatever other key growth drivers it depends on after those two also lose patent protection. That’s what makes AbbVie a stock worth buying and holding onto for good. Individual drugs will eventually stop driving top-line growth in a decade or so, but a culture centered around innovation can last a lifetime — several, actually.

Meanwhile, AbbVie has continued to increase its dividends even after the Humira patent cliff. And thanks to being a former unit of Abbott Laboratories, AbbVie qualifies as a Dividend King that has raised its payouts for 52 consecutive years. The dividend is up by 288% since the company’s inception — that’s impressive.

The drugmaker offers a strong forward yield of 3.6%, while its cash payout ratio looks reasonable at just under 49%. All this makes the stock a great pick for long-term, income-seeking investors.

2. Visa

Carrying around cash and checks is cumbersome, and these payment methods also come with other downsides. Chief among them is that they’re poorly adapted to much of modern retail activity, which happens online. Cash and check usage has been declining for years.

One of the companies helping move that trend along is Visa, which runs one of the leading payment networks in the world. It helps facilitate credit card transactions — without incurring the risk that people will default on their debt, since the company doesn’t issue the cards. It merely serves as an intermediary between issuing banks and merchants.

Visa benefits from the network effect. The more merchants join its ecosystem, the more attractive it is to consumers, and vice versa. At this point, few responsible businesses in developed countries would dare not to accept the company’s cards as a payment method.

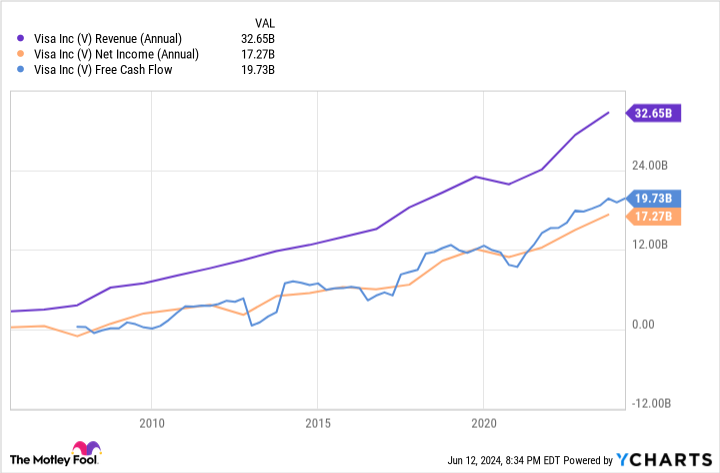

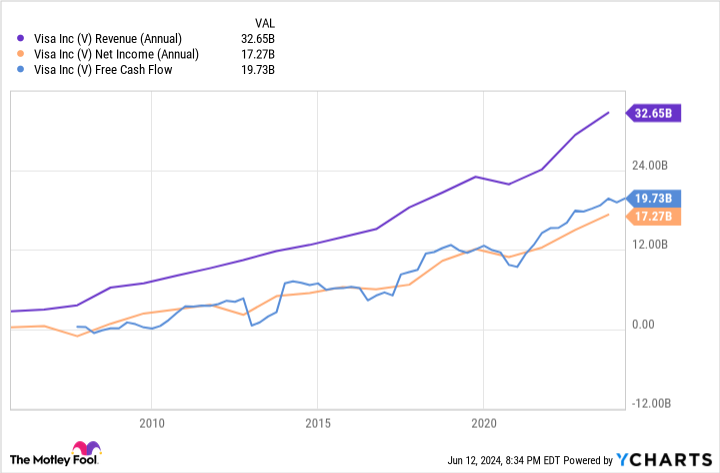

And Visa pockets a fee for every single transaction conducted with one of them. That’s a great business model. Naturally, the company’s financial results have been excellent over the years:

The future remains bright for Visa despite the progress it has already made; the company sees a $20 trillion addressable market. About half of that is in cash and checks, because despite appearances, these modes of payments haven’t disappeared — far from it. There’s a long runway for growth ahead.

But what about the dividend? While the yield isn’t impressive at just 0.8%, Visa has increased its dividend by an incredible 420% in the past decade. Yet its cash payout ratio remains modest at just about 20%.

Visa has miles of room left to boost the dividend further. That, combined with the company’s strong underlying business and attractive long-term opportunities, makes it a solid long-term dividend stock.

Should you invest $1,000 in AbbVie right now?

Before you buy stock in AbbVie, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and AbbVie wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $808,105!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of June 10, 2024

Prosper Junior Bakiny has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Abbott Laboratories and Visa. The Motley Fool has a disclosure policy.

2 Dividend Stocks That Could Pay You for Life was originally published by The Motley Fool