As we step into the new year, the business landscape and the art of mergers and acquisitions (M&A) dealmaking continues to evolve, reflecting a dynamic mix of challenges and opportunities.

A Pivotal Year Full of Uncertainties and Opportunities

The year 2025 is poised to be a pivotal year for the M&A market, characterised by potential rate cuts, changes in policies, and record-high dry powder, all of which fuel both uncertainties and opportunities. In this climate, companies are anticipated to actively leverage M&A not merely to expand their market presence but also as a strategic tool for adapting to the rapidly evolving global economic environment. This underscores the importance of agility and foresight for firms aiming to capitalise on the myriad of opportunities while skilfully navigating the associated challenges. The confluence of these dynamic factors suggests that 2025 will witness not just isolated mergers and acquisitions but a series of strategic transformations that have the potential to reshape entire industries.

Rate Cut on Standby

In 2024, the Federal Reserve executed three consecutive rate cuts, amounting to a cumulative reduction of 100 basis points, representing the most substantial annual easing initiative since 2009. With the current rate range of 4.25 percent to 4.50 percent, the Fed anticipates a slower pace of cuts in 2025 due to the persistently high inflation rate in the United States and the potential inflationary impact of President-elect Donald Trump’s proposed policies.

Lower interest rates are likely to spur an increase in M&A activities by lowering the cost of financing and boosting stock valuations, thereby narrowing the gap between buyers’ bids and sellers’ expectations. While rates are still higher than at the start of the recent tightening cycle, the anticipated rate reductions should help facilitate dealmaking, albeit without reaching the record-high activity levels seen in 2021.

Policies Shuffle

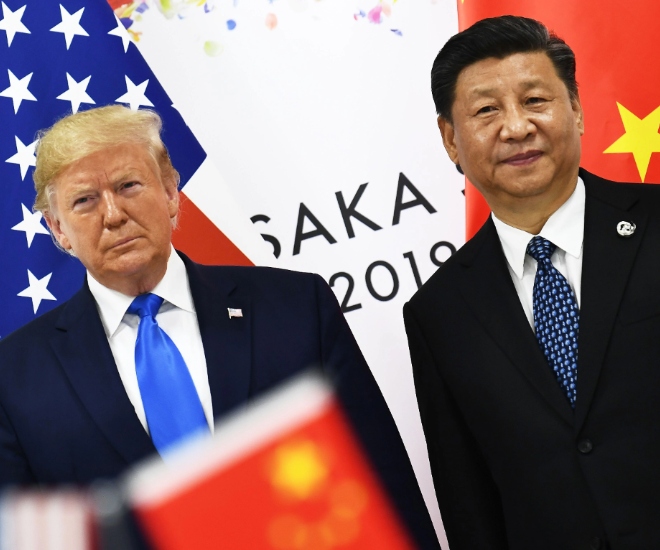

As the world shifts its focus to the new president-elect, Donald Trump, and his proposed policies, a ripple effect is expected through the economy, fundamentally reshaping regulatory frameworks, fiscal policies, and international relations, all of which can significantly influence M&A activities.

One of the key areas of impact could stem from potential tariff increases, including a blanket tariff of 10 percent to 20 percent on imports from most countries and a 60 percent average tariff on goods imported from China. This might drive cross-border M&A activities and foreign direct investments as foreign companies seek acquisition and foreign investment opportunities within the U.S. to establish “Made in America” production lines. Increased tariffs on Chinese imports and adverse policies may also lead Chinese companies to seek acquisition targets in Europe or Southeast Asia.

Meanwhile, industrialisation has emerged as a key trend in Asia, significantly driving the global economy. As Asian companies expand and evolve, there is an increasing need for them to extend their operations or relocate to neighbouring countries that offer larger land areas, better incentive policies, and lower labour costs. Consequently, there has been a notable trend of Chinese companies establishing new factories and offices in Southeast Asian countries such as Vietnam, Thailand, and Indonesia. This strategic move not only supports the companies’ organic growth but also brings new economic opportunities to the emerging markets in the region.

Record Dry Powder

Private equity firms are currently sitting on an unprecedented amount of uncalled capital, approximately USD 2 trillion, commonly referred to as “dry powder”. This substantial cash reserve has been accumulating since the last significant global M&A surge in 2021. During the past three years, M&A activity has seen a slowdown, with private equity firms shifting their focus to smaller transactions, such as corporate carve-outs. However, as we move into 2025, the landscape is set to change with heightened expectations. Many funds are beginning to shed their cautious stance, and a considerable portion of this unallocated capital is anticipated to be deployed. Moreover, funds are under increasing pressure from the Limited Partners (LPs) to make investments as they approach the midpoint of their fund life. This can potentially lead to a wave of substantial deals and acquisitions, which could redefine industry landscapes and drive significant growth across various sectors.

2025 Look Out

The year 2025 will mark a period of significant transition, with businesses navigating the evolving dynamics of a newly established administration while aiming to capitalise on emerging opportunities. Companies that can adapt swiftly to these changes are likely to gain a competitive edge, enabling them to execute strategic acquisitions and realise substantial growth. As the political and economic landscape shifts, there will be a need for agility and forward-thinking strategies, allowing organizations to not only withstand uncertainties but also thrive amidst them. Those able to preempt and respond to these changes will be well-positioned to harness new market opportunities, solidifying their foothold and driving transformational growth in the months and years ahead.

For more on M&A trends and CIGP, visit: https://cigp.com/

This article was written by Managing Partner at CIGP Hugues de Saint Seine

Click here for more on the latest in business and luxury reads.