Justice Elena Kagan grilled U.S. Solicitor General John Sauer on the practicalities of ending universal injunctions on Thursday, a major sticking point in a highly watched case centered on birthright citizenship and the power of lower courts to rule against the executive branch.

Kagan pressed Sauer Thursday on the practicalities of ending universal injunctions, and how the higher court should then be tasked with managing the flow of lower court challenges.

She also noted that the Trump administration has been “losing uniformly” in lower court cases on the “substantive question” in dealing with birthright citizenship.

SUPREME COURT TAKES ON BIRTHRIGHT CITIZENSHIP: LIBERALS BALK AT TRUMP ARGUMENT TO END NATIONWIDE INJUNCTIONS

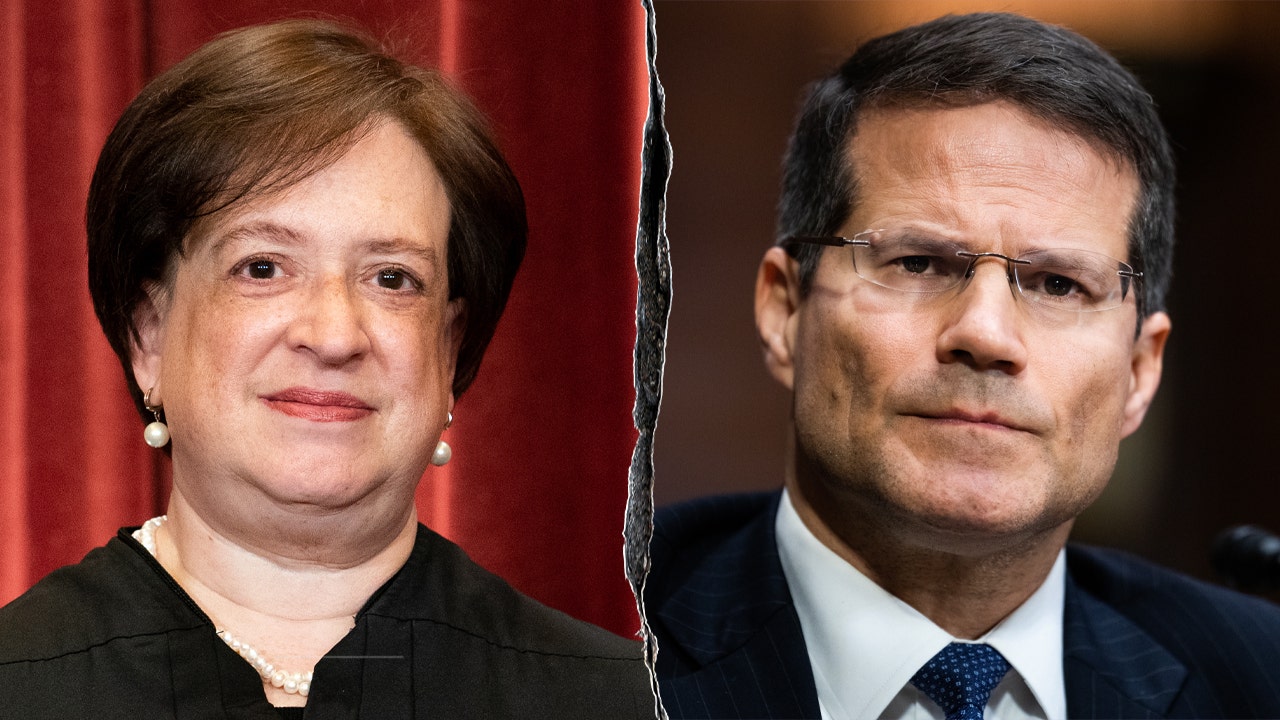

WASHINGTON, DC – SEPTEMBER 13: U.S. Supreme Court Associate Justice Elena Kagan participates in a discussion at the George Washington University Law School, September 13, 2016 in Washington, DC. (Mark Wilson/Getty Images)

“If I were in your shoes, there’s no way I’d approach the Court with this case!” Kagan quipped.

After he attempted to answer, she responded that “This is not a hypothetical – this is happening out there.”

D. John Sauer, nominee to be solicitor general, testifies during his Senate Judiciary Committee confirmation hearing in Dirksen building on Wednesday, February 26, 2025. (Tom Williams/CQ-Roll Call, Inc via Getty Images)

“Every court is ruling against you.”

Justices on the high court agreed in April to hear the case, which centers on three lower courts that issued national injunctions earlier this year blocking Trump’s executive order on birthright citizenship.

President Donald Trump signs an executive order after delivering remarks on reciprocal tariffs during an event in the Rose Garden entitled “Make America Wealthy Again” at the White House in Washington, DC, on April 2, 2025 (SAUL LOEB/AFP via Getty Images)

CLICK TO GET THE FOX NEWS APP

The order reinterprets the 14th Amendment to deny automatic U.S. citizenship to children born in the U.S. if their mother is unlawfully present or temporarily in the country, and if their father is neither a U.S. citizen nor a lawful permanent resident at time of birth. Trump’s action remains on hold nationwide pending Supreme Court intervention.

A Supreme Court decision here could have sweeping national implications, setting a precedent that would affect the more than 310 federal lawsuits that have challenged White House actions since Trump’s second presidency began on Jan. 20, 2025, according to a Fox News data analysis.