Although the artificial intelligence (AI) sell-off due to DeepSeek’s generative AI model innovation was short-lived, a handful of stocks are still off their peaks. One of them is AI king Nvidia (NASDAQ: NVDA), a company that provides the computing power necessary to train all of these AI models.

At the time of this writing, Nvidia is still over 10% down from its 2025 high, although it was down over 20% at the depths of the sell-off. I still think this slight sale price represents a fantastic buying opportunity, as the stock looks primed to soar after Feb. 26.

On Feb. 26, Nvidia will report its fourth-quarter of fiscal year 2025 earnings (ending around Jan. 31). Nvidia’s earnings report has become quite the event because everyone is curious if they are going to continue posting ludicrous growth numbers. For Q4, management expects revenue of $37.5 billion, which would indicate 70% year-over-year growth. Wall Street analysts are convinced that Nvidia undershot its revenue projection, as they estimate 73% growth on average.

This is because Nvidia has a strong track record of exceeding expectations. In Q3, management expected $32.5 billion but generated $35.1 billion. For Q2, they expected $28 billion but generated $30 billion. Considering how much money has been spent on AI over the past quarter, I’d say that Nvidia likely exceeds that $37.5 billion mark they set for themselves.

Nvidia’s business has been so strong because of its best-in-class graphics processing units (GPUs) and software. GPUs have a distinct advantage over CPUs: They can process multiple calculations in parallel, resulting in far greater computing power. This effect can be amplified by combining thousands of GPUs in a cluster.

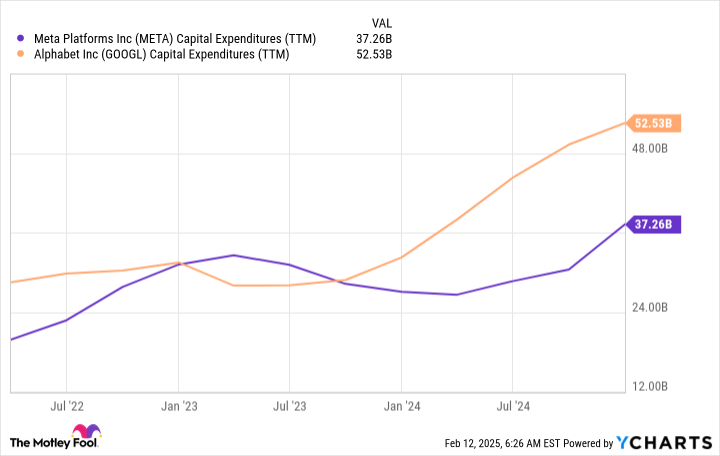

While the AI computing hardware buildout was significant in 2023 and 2024, 2025 will represent another peak in AI hardware spending. Some of the biggest companies have indicated that a large chunk of the capital expenditures for 2025 will be dedicated to AI hardware, and these numbers are incredibly high. Meta Platforms plans to spend between $60 billion and $65 billion on capital expenditures this year, and Alphabet plans to spend $75 billion. For reference, this is what the capital expenditures over a rolling 12-month period looked like for both companies.

A huge chunk of money will be spent in 2025, and Nvidia is primed to benefit from that spending. However, the stock doesn’t look like it has priced much of that in.

Despite a promising 2025 ahead, Nvidia’s stock really doesn’t look all that expensive anymore.