Markets fell midday Tuesday as the Fed kicked off its two-day policy meeting.

Tomorrow afternoon, the Fed is expected to announce it will hold interest rates steady. Investors will also be paying attention to corporate earnings from Amazon.com Inc. which is set to report today after the bell, and Apple Inc., which reports on Thursday.

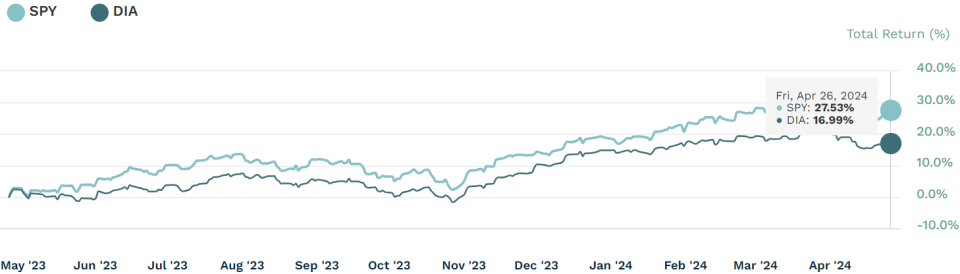

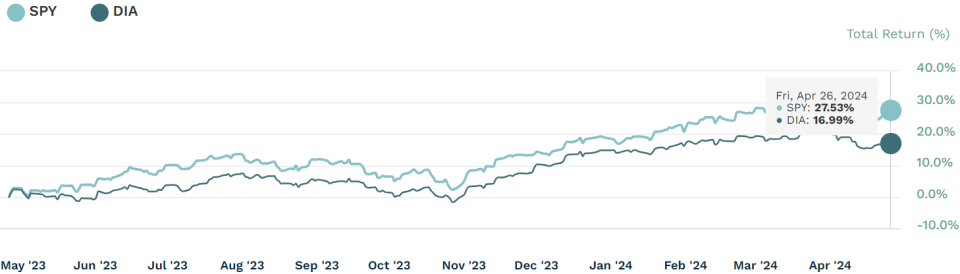

SPY, the SPDR S&P 500 ETF Trust slid more than half a percentage point as the S&P 500 took a leg lower by midday trading. DIA, the SPDR Dow Jones Industrial Average ETF Trust was also in the red at midday, sinking nearly 1%. Markets are headed toward an April decline, the first monthly drop since November.

SPY vs DIA Performance

Source: etf.com

Tech stocks are also in the red as investors get ready for two Mag 7 stocks, Amazon and Apple, to report this week. QQQ, the Invesco QQQ Trust which tracks the tech-heavy Nasdaq, slid by more than three-quarters of a point. MAGS, the Roundhill Magnificent Seven ETF which holds the Magnificent Seven in its fund, dropped nearly 1.5% at midday.

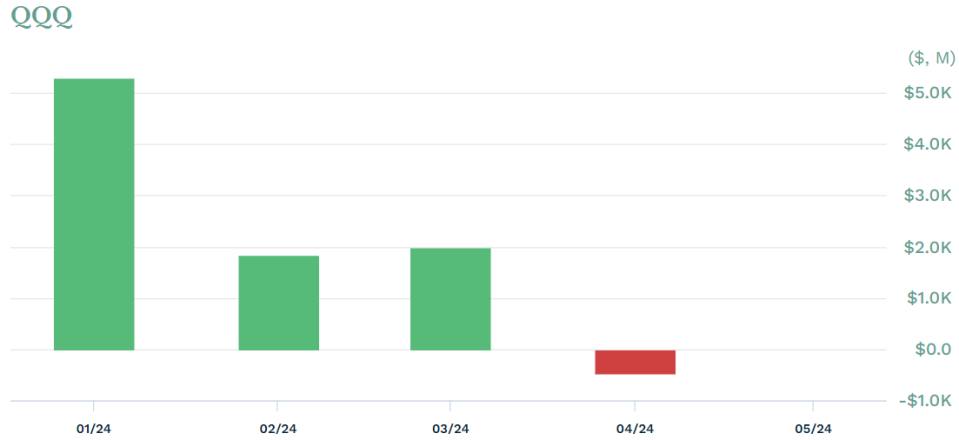

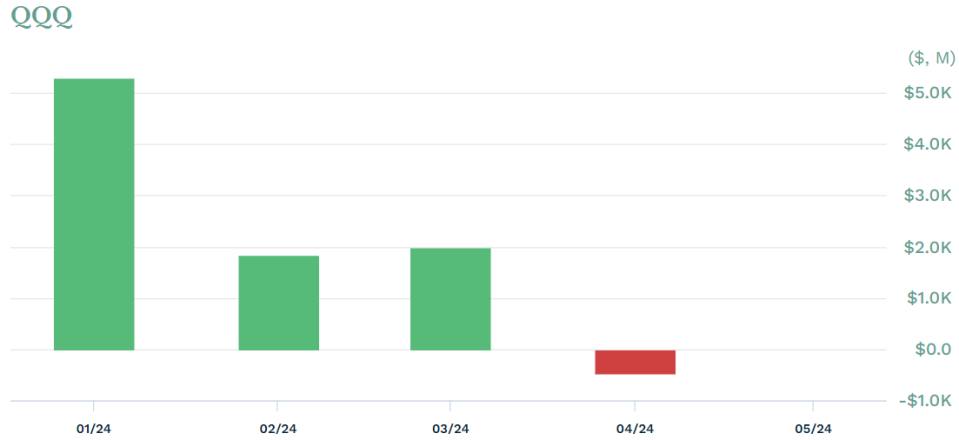

Inflows in technology ETFs have risen this year as investors, beaten down by a “higher for longer” rate environment, have turned to high growth stocks and funds for gains.

MAGS has seen inflows of just over $197M so far this year, according to etf.com data. Meanwhile QQQ inflows have topped $8.6B.

QQQ 2024 Fund Flows

Source: etf.com

Tech has continued to perform well in 2024, despite higher interest rates that typically keep high growth stocks under pressure. Wednesday, the Federal Reserve is expected to hold rates steady as persistent inflation keeps the Fed hawkish.

According to the CME Fed Watch Tool, investors are not forecasting a rate cut until September. Traders had started 2024 with the belief that the Fed would deliver 6 rate cuts this year, an expectation that has now been slashed to just one.

Permalink | © Copyright 2024 etf.com. All rights reserved