Uncertainty is the word of the day, in reference to the near-term economic future. Sentiment will hinge on the inflation numbers due out next week. March’s figure rose to 3.5%, and April’s job numbers showed a marked slowing in the labor market; that combination has stoked fears of stagflation.

But – corporate earnings from Q1 are beating expectations, and the stock market has taken a turn for the better with the S&P 500 closing just below 5,200 yesterday. Economic strategists are still optimistic that the Federal Reserve will move to cut interest rates later this year.

So, there are cases to be made for both the bears and the bulls right now, making the environment one tailored for astute stock picking.

With this in mind, the Morgan Stanley analysts are pounding the table on two stocks in particular, arguing they are well-positioned to deliver handsome returns in the year ahead – in one case, as much as 110%.

Using the TipRanks platform, we’ve looked up the big-picture view on both of these picks and it looks like the rest of the Street agrees with the MS take – both are rated Strong Buys by the analyst consensus. Here are the details, with comments from the Morgan Stanley analysts.

Auna S.A. (AUNA)

We’ll start in the healthcare sector, where Auna is a leading provider of healthcare services in many of the Spanish-speaking countries in Latin America. Auna’s presence is particularly strong in Mexico, Colombia, and Peru, and the company has built up one of Latin America’s largest – and most modern – healthcare networks.

By the numbers, Auna is impressive. The company operates 31 healthcare facilities with a total of 2,308 in-patient beds and employs approximately 14,900 people across its network. Auna can boast of 1.3 million plan memberships, a strong customer base, and brings in approximately $1 billion in annual revenue. The company uses a patient-centric model that incentivizes preventative care and concentrates its resources in the treatment of ‘high-complexity diseases.’

This company went public on the New York Stock Exchange in March of this year, through an IPO that saw 30 million class A shares go on the market at $12 each. The offering brought in $360 million in gross proceeds. In financial releases connected to the public offering, Auna reported that 2023 revenues totaled US$1.05 billion, while adjusted EBITDA came in at US$223 million. These totals were up strongly year-over-year, by 58% and 90% respectively. Auna is the first Latin American healthcare services provider to go public on Wall Street.

Covering this newly public stock for Morgan Stanley, Mauricio Cepeda sees multiple paths toward expansion. He writes of Auna, “We see Auna expanding earnings in 2024 from 3 main fronts: (i) the ramp-up of its hospital occupancy in Monterrey, from 42% to 47%, expanding the total company EBITDA by 11% (+PEN 88mn) given the relevance of the Mexican operation; (ii) additional maturation of the business in Peru and Colombia, and (iii) a deleveraging affect from its strong OCF with little CAPEX need (organic phase). Besides, we see growth avenues in the years ahead to justify strong multiples, notably the opportunity to introduce health plans in Mexico (mimicking the success in Peru) and the possibility to continue the ramp-up in Monterrey (which may have nearshoring upside).”

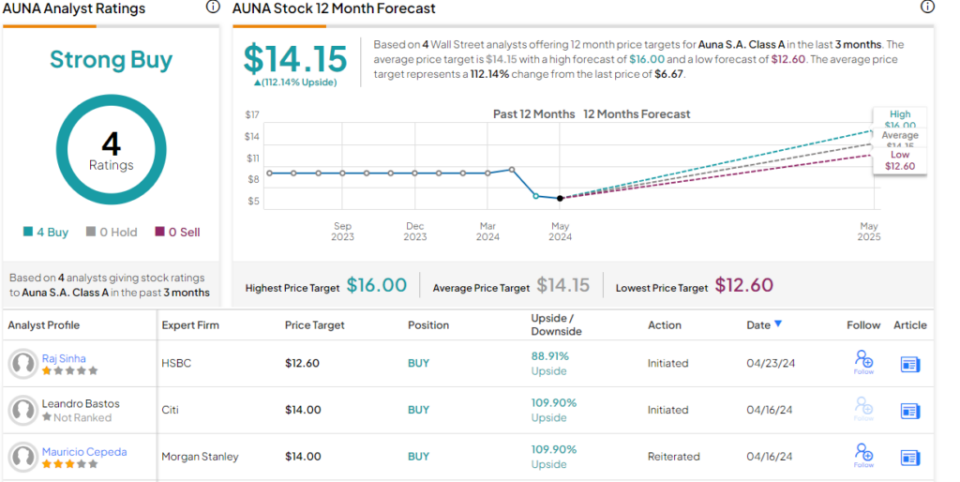

Cepeda’s views back up his Overweight (Buy) rating on the stock, and his $14 price-target points toward a robust 110% upside potential for the next 12 months. (To watch Cepeda’s track record, click here)

Overall, it’s clear that Wall Street likes this new stock; AUNA shares have picked up 4 recent analyst reviews in their short time on the public markets, and those reviews are all positive – for a unanimous Strong Buy consensus rating. The stock is priced at $6.67, and its $14.15 average price target is slightly more bullish than the MS take, suggesting a 112% gain for the year ahead. (See AUNA stock forecast)

Contineum Therapeutics (CTNM)

Next up is Contineum Therapeutics, a San Diego-based biopharmaceutical firm engaged in clinical-stage research on neuroscience, inflammation, and immunology indications. The company is working to develop novel small molecule therapeutic agents to use as orally dosed treatments for neuroinflammatory diseases. This is a class of disease conditions with high unmet medical needs – that is, current treatment options are not considered sufficiently effective, and the field is wide open for a biotech firm that can create new treatments.

Currently, Contineum has two drug candidates in its research program, PIPE-791 and PIPE-307. The first is a wholly owned asset, and the second is under development in collaboration with Johnson & Johnson. Each drug candidate showed promise in early testing, and each currently has two clinical programs under way or in preparation.

PIPE-791 is a small molecule antagonist of the lysophosphatidic acid 1 receptor (LPA1R), and is being developed as a potential treatment for two conditions, idiopathic pulmonary fibrosis (IPF) as well as progressive multiple sclerosis (MS). The drug is currently undergoing a Phase 1 trial for the treatment of IPF; results of this trial, which is on healthy volunteers, will be used to support Phase 1b trials in both IPF and progressive MS.

On the PIPE-307 track, the Phase 1 trials on healthy volunteers have been completed and the company has initiated a Phase 2 trial in the treatment of RRMS. This drug candidate, like -791 above, also has potential in a second indication, this one in the treatment of depression. PIPE-307 is another small molecule compound, and is a selective inhibitor of the muscarinic type 1 M1 receptor (M1R).

Moving drug candidates out of the early clinical testing phase into more advanced studies does not come cheap, and Contineum held an IPO in April of this year to raise funds. The company put 6.9 million shares on the market at an initial price of $16 each; this was a downgrade from the original filing, which called for 8.8 million shares to go on sale priced in the range of $16 to $18. In the event, Contineum raised $110 million in gross proceeds.

This company has attracted the attention of Morgan Stanley analyst Jeffrey Hung. The 5-star biotech expert sees -791 as the key point for investors to watch, but is also optimistic on PIPE-307. He writes of CTNM, “PIPE-791 has the potential to be best-in-class… Although Contineum’s data are relatively early, we are encouraged by the company’s preclinical data suggesting PIPE-791 is ~30x more potent at reducing LPA-induced collagen production than BMS-986278. We think PIPE-791’s increased receptor exposure with low dosing due to high oral bioavailability and low plasma protein binding could help improve its safety profile… For PIPE-307, M1R antagonism is clinically validated in both depression and RRMS, and the partnership with JNJ further validates Contineum’s approach.”

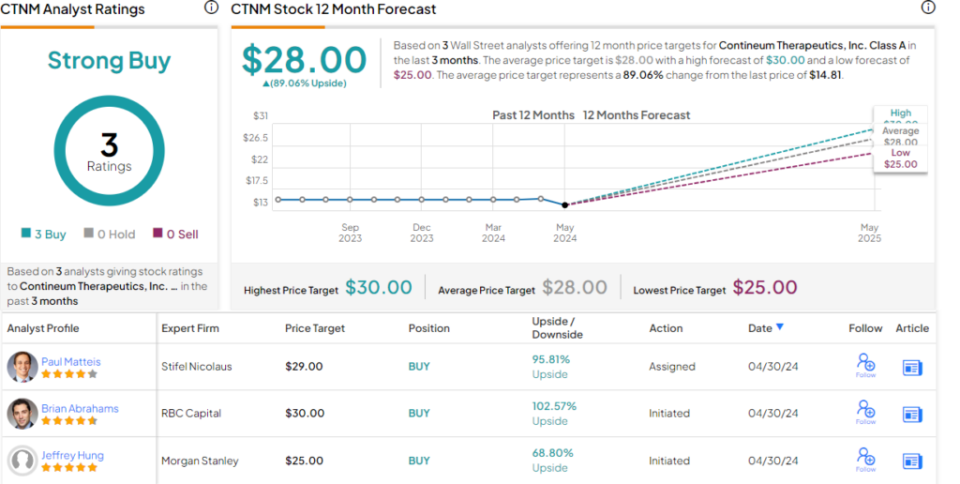

Hung goes on to put an Overweight (Buy) rating on this stock, and he complements that with a $25 price target, suggesting the shares have a 69% upside potential on the one-year horizon. (To watch Hung’s track record, click here)

This is another stock with a unanimous Strong Buy consensus rating, based on 3 recent positive analyst reviews. Contineum’s shares are priced at $14.81 and have an average target price of $28, implying a strong upside potential of 89%. (See CTNM stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.