The PHLX Semiconductor Sector index has enjoyed solid gains in the past year, rising a healthy 59% as of this writing thanks to the booming demand for chips that are used for powering artificial intelligence (AI) servers and applications. But not all chip stocks have benefited from this impressive rally.

Shares of Intel (NASDAQ: INTC) have remained flat in the past year. A big reason behind that underperformance is Intel stock’s steep 37% decline in 2024, which can be attributed to the company’s failure to live up to Wall Street’s expectations. Intel’s fourth-quarter 2023 results, which were released in January, failed to satisfy Wall Street’s expectations and the stock fell 12% in a day.

A similar story unfolded after the release of the company’s first-quarter 2024 results. Let’s see why that was the case and check if Intel could come out of its slump thanks to catalysts such as AI to become a top stock over the next five years.

Intel is showing signs of improvement

Intel released its Q1 results on April 25, reporting a 9% year-over-year increase in revenue to $12.7 billion. More importantly, the company reported an adjusted profit of $0.18 per share from a loss of $0.04 per share in the same quarter last year. The company enjoyed a healthy year-over-year increase of 8.2 percentage points in the gross margin thanks to a solid turnaround in its personal computer (PC) business.

Intel’s top line matched analysts’ estimates, while its earnings were higher than the consensus forecast of $0.13 per share. However, the outlook wasn’t up to the mark. Intel is expecting Q2 revenue of $13 billion at the midpoint of its guidance range, along with adjusted earnings of $0.10 per share. Wall Street was looking for $13.6 billion in revenue from the company, which explains why investors pressed the panic button.

But then, investors shouldn’t forget that Intel’s quarterly guidance points toward a slight improvement in the top line from the year-ago period’s reading of $12.9 billion. It is worth noting that Intel’s revenue was down 15% on a year-over-year basis during the same period last year. More importantly, the company is expecting its full-year revenue and earnings to increase in 2024. That would be a big improvement over last year when its revenue was down 14% and adjusted earnings fell 37% to $1.05 per share.

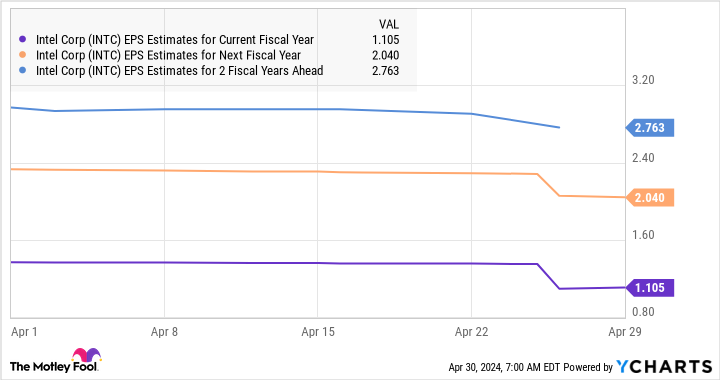

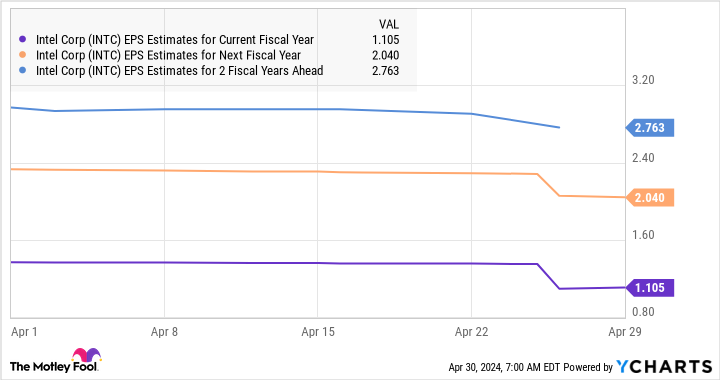

Additionally, as the chart below indicates, analysts are expecting Intel’s earnings to increase at a nice pace from next year.

A closer look at how Intel’s key segments are performing will help investors understand that the company’s growth could indeed pick up in the coming years.

The bigger picture appears to be bright

Intel’s client computing group (CCG) is its biggest business segment, producing 59% of its revenue in the previous quarter. The segment’s revenue shot up 31% year over year thanks to the growing demand for AI-enabled PCs. The company claims that it has shipped more than 5 million AI-enabled PCs since December last year, and it “expects to exceed its prior forecast of 40 million AI PCs by the end of 2024.”

The market for AI PCs presents a secular growth opportunity for Intel. The demand for AI-enabled PCs is expected to grow at an annual pace of 44% between 2024 and 2028, hitting annual shipments of 205 million units in 2028, according to market research firm Canalys. Intel investors, therefore, can expect the company’s CCG business to keep growing at a nice clip over the next four to five years.

At the same time, the company’s data center and AI (DCAI) business returned to growth in the previous quarter. The segment’s revenue was up 5% year over year to $3 billion. For comparison, Intel’s DCAI revenue was down a massive 39% year over year in the first quarter of 2023.

Intel is sitting on a huge growth opportunity in the data center market thanks to the AI chip boom. The market for AI chips is expected to clock a compound annual growth rate of 39% through 2029, according to Mordor Intelligence. Though this market is currently dominated by Nvidia, Intel is trying to cut its teeth in AI chips with its new Gaudi 3 processor.

Intel claims that this new chip is “projected to deliver on average 50% faster inference and 40% greater inference power efficiency than Nvidia H100 on leading generative AI (GenAI) models.” Intel expects Gaudi 3 to help generate more than $500 million in revenue in the second half of the year. Even better, Intel is forecasting the Gaudi 3 to gain more momentum next year thanks to its focus on improving the supply of this processor as well as its ability to reduce operating costs.

Given that the AI chip market is currently in its early phases of growth and is expected to grow at a nice pace for a long time, there is ample opportunity for Intel’s DCAI business to improve further. Analysts are expecting Intel’s earnings to increase at an annual rate of 37% over the next five years.

Based on Intel’s 2023 earnings of $1.05 per share, its bottom line could jump to $5.07 per share at the end of 2028. Multiplying the projected earnings with Intel’s five-year average forward earnings multiple of 14.5 indicates a stock price of $73 after five years, which would be a 135% increase from current levels.

As such, it won’t be surprising to see Intel stock regaining its mojo and jumping impressively over the next five years thanks to the AI-related catalysts discussed above. Investors can consider using the drop in this semiconductor stock as a buying opportunity.

Should you invest $1,000 in Intel right now?

Before you buy stock in Intel, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Intel wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $544,015!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of April 30, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel and short May 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

Where Will Intel Stock Be in 5 Years? was originally published by The Motley Fool