Were it not for the pressures put on car brands by the ZEV Mandate targets the UK’s new car market in 2024 would be seen as quite a success story.

That’s what Mike Hawes, chief executive of the Society of Motor Manufacturers and Traders, told Automotive Management in a briefing on Friday, ahead of the official publication of 2024’s results on Monday.

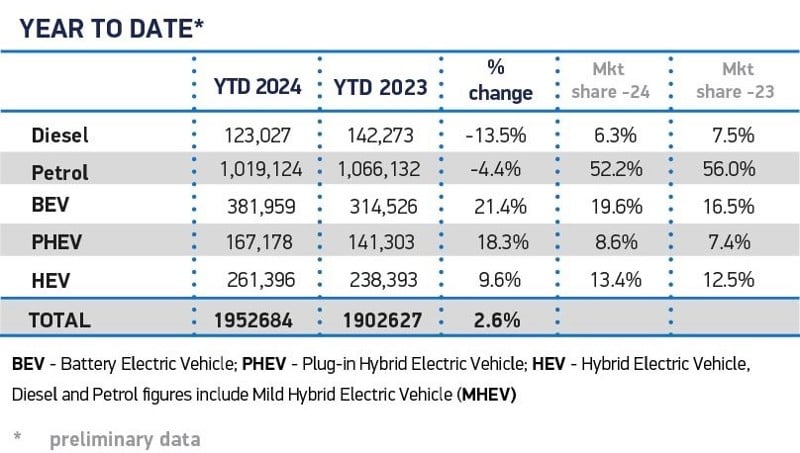

Preliminary data for the 2024 year-end shows the new car market ended at 1.953 million units, up 2.6% year-on-year, of which 382,000 were zero emission battery electric vehicles. That result gave BEV a record market share of 19.6%.

But that record performance, driven by significant discounts and incentives which the SMMT says are “unsustainable”, was still almost 3ppts short of the Government-set target of a 22% share, even after a final push that created a 31% BEV mix in December’s market to boost the tally. That means that some carmakers’ national sales companies here are liable to be fined, if they cannot pool, trade or borrow zero carbon credits from other vehicle manufacturers which have exceeded the target.

“Some industry figures have suggested the natural level of demand is around 11% to 12 % so that is why the market was having to be pushed. It’s clear that demand has not matched the assumptions behind the mandate when it was conceived,” Hawes said.

When the mandate was first conceived the forecast for this year was 23.3% BEV share.

The target increases to 28% BEV share this year. That will require a sales uplift of 46% – to find customers for more than 550,000 new electric cars if the total market volume remains flat.

“Industry has pulled every lever to try and achieve this target, with manufacturer discounting totalling more than £4.5 billion in 2024, an amount that is not sustainable in the long term. Billions of pounds of investment in new technologies and products over the past decade have delivered a record 132 ZEV models to the UK market, up 38% since 2023 to account for a third of all models available, with an average range of almost 280 miles – more than two weeks’ of driving for most people,” said the SMMT.

The 2.6% growth in 2024’s new car market was driven purely by the fleet sector, including leasing operations, rental firms and OEMs’ own fleets, which accounted for 60% of all registrations. Hawes is concerned that new cars are not attracting the typical numbers of private buyers, who traditionally would account for half of the demand, and said this is of course against an economic backdrop but also “add in a degree of confusion about what type of vehicle to buy after the messages from government over the last two years to understand why there’s a reason to hold off”.

The 2.6% growth in 2024’s new car market was driven purely by the fleet sector, including leasing operations, rental firms and OEMs’ own fleets, which accounted for 60% of all registrations. Hawes is concerned that new cars are not attracting the typical numbers of private buyers, who traditionally would account for half of the demand, and said this is of course against an economic backdrop but also “add in a degree of confusion about what type of vehicle to buy after the messages from government over the last two years to understand why there’s a reason to hold off”.

He noted pointedly that consumers are now on their fourth prime minister since the 2030 deadline for the end of petrol and diesel car sales was abruptly announced by Boris Johnson in November 2020. That was adjusted to 2035 by Rishi Sunak, and now Kier Starmer wants it restored to 2030.

SMMT data shows fewer private buyers bought a new car in 2024 than in 2020, when the COVID pandemic closed down the industry for three months.

BEV and PHEV cars carry a price premium and SMMT data shows that private motorists are picking petrol primarily, and hybrid secondly. Buyers’ low interest in BEVs is hampering the market’s growth, Hawes warns, and incentives such as halving VAT, delaying the premium VED changes and equalising the VAT rate on public charging to the 5% on domestic power.

An industry consultation is under way on possible changes to the ZEV Mandate and how the UK Government’s aims to end ICE car sales in 2030 could be achieved.

The costs of business in the UK has led Stellantis to announce the closure of its vehicle assembly plant in Luton.

The DfT consultation closes in mid-February and the Government then allows itself 12 weeks to respond. Hawes said the industry deperately needs to know the outcome sooner, but it’s unlikely.

“We will be pushing for clarity so that, at least, in the second half of the year you can have some of planning what the requirements may be,” Hawes added.